All Categories

Featured

Table of Contents

- – Renowned Accredited Investor Alternative Inves...

- – Best Accredited Investor Secured Investment Op...

- – Expert Accredited Investor Secured Investment...

- – Streamlined Accredited Investor Real Estate D...

- – First-Class Accredited Investor Real Estate ...

- – Reliable Accredited Investor Alternative Inv...

- – Specialist Investment Platforms For Accredit...

The policies for certified investors differ amongst territories. In the U.S, the definition of an approved capitalist is put forth by the SEC in Regulation 501 of Regulation D. To be a certified investor, an individual has to have a yearly revenue going beyond $200,000 ($300,000 for joint revenue) for the last two years with the assumption of gaining the very same or a higher income in the existing year.

This quantity can not include a main house., executive officers, or supervisors of a company that is providing non listed safety and securities.

Renowned Accredited Investor Alternative Investment Deals

If an entity is composed of equity proprietors that are accredited investors, the entity itself is a recognized capitalist. However, an organization can not be created with the single function of purchasing details protections - accredited investor wealth-building opportunities. A person can qualify as an accredited financier by demonstrating sufficient education and learning or job experience in the economic industry

People that want to be approved financiers do not put on the SEC for the designation. Rather, it is the responsibility of the business providing an exclusive placement to make certain that all of those come close to are certified capitalists. Individuals or events that want to be approved financiers can approach the issuer of the unregistered safeties.

Suppose there is an individual whose earnings was $150,000 for the last three years. They reported a key residence value of $1 million (with a mortgage of $200,000), an automobile worth $100,000 (with an outstanding financing of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Net worth is determined as possessions minus responsibilities. He or she's total assets is precisely $1 million. This includes an estimation of their properties (besides their key residence) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan equaling $50,000. Considering that they satisfy the net worth requirement, they certify to be a certified financier.

Best Accredited Investor Secured Investment Opportunities for Financial Freedom

There are a few much less usual qualifications, such as managing a trust with greater than $5 million in assets. Under federal safety and securities legislations, just those that are approved capitalists may take part in specific safety and securities offerings. These may include shares in private positionings, structured items, and exclusive equity or bush funds, to name a few.

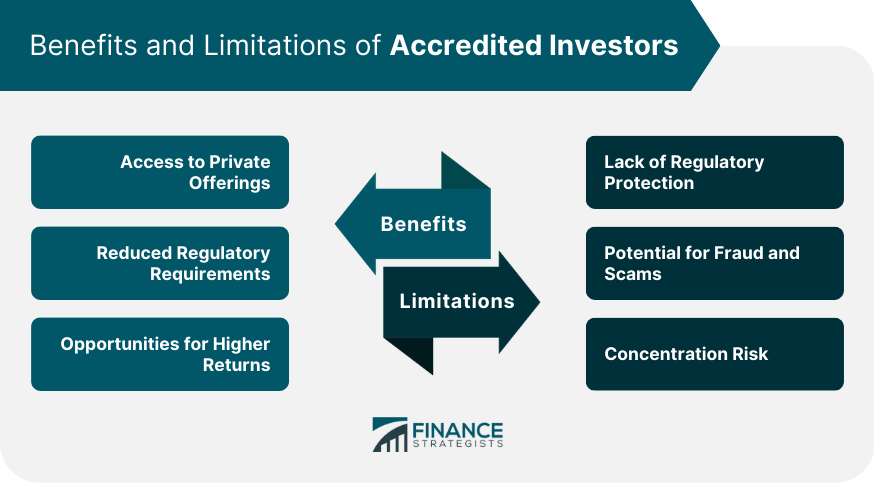

The regulatory authorities intend to be particular that individuals in these extremely dangerous and complicated investments can take care of themselves and evaluate the risks in the lack of government security. The recognized capitalist policies are designed to secure possible financiers with limited financial expertise from adventures and losses they might be unwell outfitted to hold up against.

Accredited financiers meet certifications and expert standards to accessibility special investment chances. Certified investors need to meet earnings and internet worth needs, unlike non-accredited individuals, and can invest without constraints.

Expert Accredited Investor Secured Investment Opportunities

Some vital adjustments made in 2020 by the SEC consist of:. This adjustment acknowledges that these entity types are frequently used for making investments.

This change make up the impacts of rising cost of living over time. These modifications expand the recognized investor swimming pool by around 64 million Americans. This wider gain access to provides extra chances for capitalists, however additionally boosts possible dangers as much less monetarily advanced, financiers can get involved. Organizations using exclusive offerings may gain from a larger swimming pool of prospective investors.

These investment choices are special to recognized capitalists and establishments that certify as a certified, per SEC policies. This offers certified financiers the chance to invest in arising firms at a stage before they think about going public.

Streamlined Accredited Investor Real Estate Deals

They are checked out as investments and come only, to certified clients. In addition to well-known business, certified financiers can choose to buy start-ups and up-and-coming ventures. This supplies them tax returns and the possibility to enter at an earlier phase and potentially enjoy rewards if the firm flourishes.

For capitalists open to the dangers included, backing startups can lead to gains (accredited investor investment returns). A lot of today's tech companies such as Facebook, Uber and Airbnb came from as early-stage startups supported by accredited angel investors. Innovative capitalists have the possibility to explore investment choices that may produce more earnings than what public markets supply

First-Class Accredited Investor Real Estate Deals for High Returns

Although returns are not ensured, diversity and profile enhancement options are expanded for capitalists. By diversifying their profiles with these expanded investment methods approved financiers can improve their approaches and potentially accomplish premium lasting returns with proper risk management. Seasoned investors usually come across financial investment options that may not be quickly available to the basic financier.

Financial investment alternatives and protections used to approved financiers usually involve greater risks. Exclusive equity, venture funding and hedge funds typically focus on investing in assets that carry danger yet can be sold off conveniently for the possibility of higher returns on those high-risk investments. Looking into before spending is crucial these in scenarios.

Lock up periods prevent financiers from taking out funds for more months and years on end. Capitalists may battle to properly value exclusive assets.

Reliable Accredited Investor Alternative Investment Deals

This modification might extend recognized capitalist condition to a series of people. Updating the revenue and property standards for rising cost of living to guarantee they show modifications as time advances. The existing thresholds have actually stayed static since 1982. Allowing partners in fully commited connections to incorporate their sources for shared qualification as accredited financiers.

Allowing people with specific specialist certifications, such as Series 7 or CFA, to qualify as recognized capitalists. Creating extra needs such as proof of financial proficiency or efficiently finishing an accredited investor exam.

On the various other hand, it could likewise result in seasoned capitalists presuming extreme dangers that might not be ideal for them. Existing accredited investors might encounter raised competition for the ideal investment opportunities if the swimming pool expands.

Specialist Investment Platforms For Accredited Investors

Those who are presently taken into consideration recognized investors should remain upgraded on any kind of changes to the requirements and guidelines. Organizations looking for recognized investors must remain alert regarding these updates to guarantee they are drawing in the right target market of capitalists.

Table of Contents

- – Renowned Accredited Investor Alternative Inves...

- – Best Accredited Investor Secured Investment Op...

- – Expert Accredited Investor Secured Investment...

- – Streamlined Accredited Investor Real Estate D...

- – First-Class Accredited Investor Real Estate ...

- – Reliable Accredited Investor Alternative Inv...

- – Specialist Investment Platforms For Accredit...

Latest Posts

What Is Tax Surplus

2020 Delinquent Tax Sale

Government Property Tax Sales

More

Latest Posts

What Is Tax Surplus

2020 Delinquent Tax Sale

Government Property Tax Sales